JGP: Eliminating commodity-driven deforestation through active ownership, creative financing, and nature restoration

By JGP Asset Management | December 11, 2023

Brazil must lead the way in addressing deforestation

In Brazil we are on the frontline of deforestation. Unlike in Europe and the US, where transport and energy can dominate climate discussions, the Brazilian economy is dominated by commodity businesses. Supply chains are heavily exposed to deforestation, and land-use is our biggest source of emissions.

This means deforestation represents a real financial risk that we need to deal with if we want to preserve and capture value for our clients, and one reason why we, along with the 30+ other financial institutions that are members of Finance Sector Deforestation Action (FSDA), have committed to eliminate the agriculture commodity-driven deforestation in our portfolios by 2025. This ambition to eliminate deforestation forms one pillar of JGP’s approach to enabling the Glasgow Guidelines, and is a vital part of our efforts to reach net zero by 2040.

Assessing risk and mapping exposure

Our work to tackle deforestation begins with a focus on risk management. We use a proprietary ESG framework to identify companies exposed to deforestation and assess their practices and how they are addressing the issue. We also consult Forest 500 and the CDP Forests questionnaire to inform our analyses.

We then use varying combinations of stewardship, engagement, and active ownership to encourage and help facilitate a shift towards deforestation-free supply chains.

Active ownership as a force for change

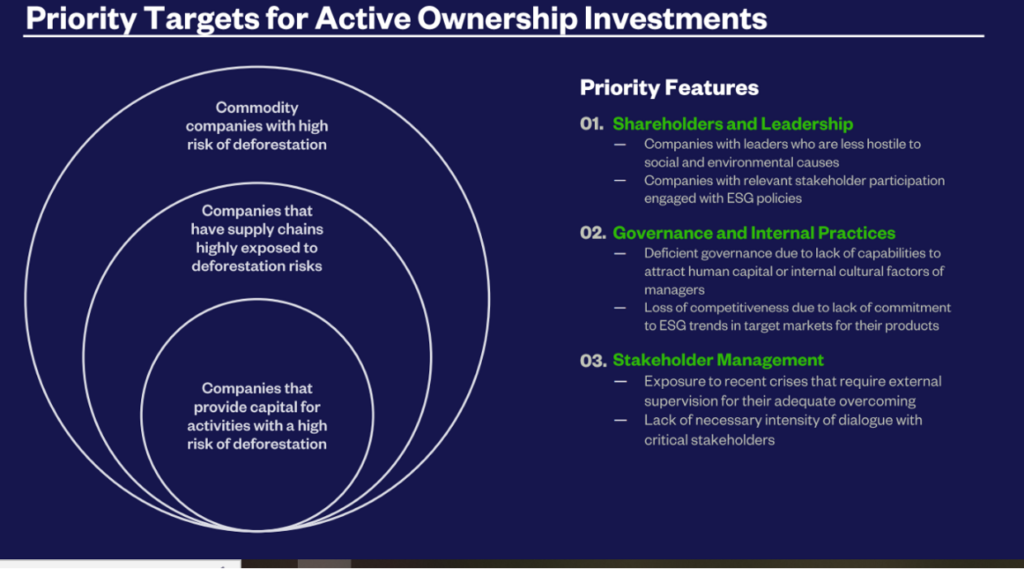

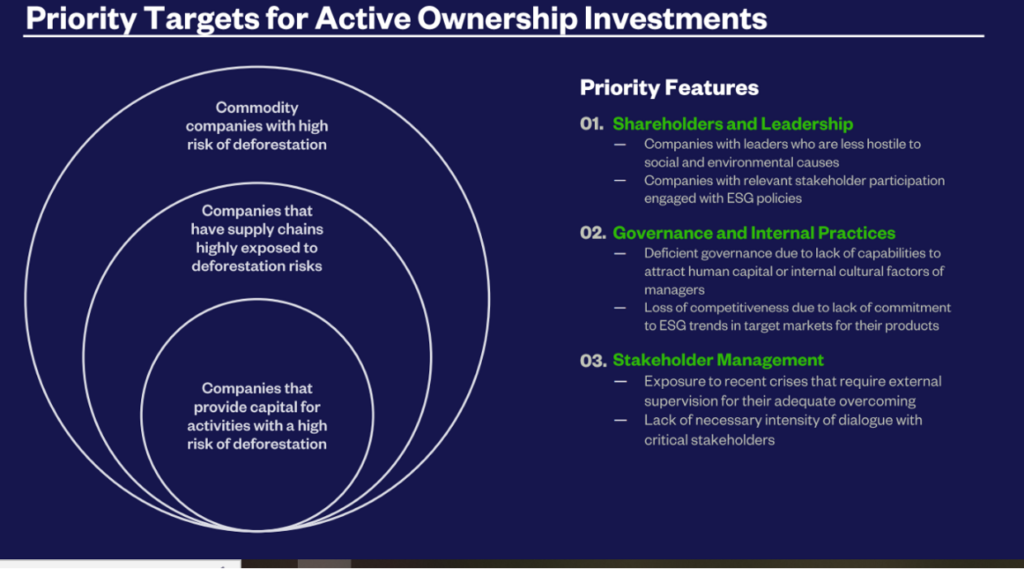

We believe we can best work towards ending deforestation by forging close partnerships with the agricultural commodity sectors and use the results of our risk analysis as the basis for our active ownership strategy that makes targeted investments in companies directly exposed to deforestation, companies that buy products from deforestation, and those that finance deforestation.

Our number one rule is that we only invest if can engage – not confrontationally, but as an ally, The FSDA Initiative clearly outlines expectations based on relevant science and best practices for companies to achieve sustainable production and develop goals with zero deforestation. To reach this objective, we work by building a constructive relationship and trust as a force for good.

This active ownership approach includes pre-engagement with company management to measure the receptiveness of our transformation proposals, supporting on C-level and board decisions, use of shareholder resolutions, and engagement with companies’ external stakeholders.

We often find that CEOs have no cultural opposition to addressing deforestation. They understand it represents a threat to their financial performance and know that putting in place proper deforestation-related policies and procedures has benefits for both investor and company. However, lack of shareholder pressure in the past has resulted in little change. We work with companies to increase transparency, pushing for robust guidelines, more sustainable production chains and an accelerated food transition.

For example, Brazilian meatpacker JBS has set science-based climate targets and are aiming to have full supply chain traceability by 2025. It’s very important to us that JBS realises these goals, and part of our active ownership engagement with the company to ensure it does.

Leveraging the collective strength of the FSDA, we also collaboratively engage with companies identified as having high forest risk to enhance our efforts towards achieving zero deforestation.

Our engagement activity is not restricted to companies; we also need a supportive a policy environment to encourage and enable zero-deforestation supply chains. We need to see governments put policies in place so commodity businesses with ambitious climate and nature targets can remain competitive.

Collaboration is key here, and we are part of Investors Policy Dialogue on Deforestation (IPDD), a US$10 trillion strong investor engagement in dialogue with governments on deforestation.

Creative financing solutions to transform supply chains

In addition to active engagement with highly exposed companies, innovative financing structures are key to supporting the transition to deforestation-free business models across supply chains.

Together with the other 14 signatories of IFACC (Innovative Finance for the Amazon, Cerrado and Chaco), we have collectively committed US$4.3 billion for deforestation –and conversion-free soy and cattle production in South America. We have already disbursed US$111 million to farmers as part of this scheme, including through our new ‘GreenGalaxy’ programme that securitises agricultural receivables to fund small and medium farmers – enabling them to transition to regenerative agriculture by raising yields on cleared lands, while avoiding deforestation.

Mobilizing capital for nature restoration

We need to work to restore degraded areas alongside ending deforestation, and land agroforestry -– a mixture of trees and agriculture – represents a huge opportunity to invest in nature and provide sustainable livelihoods in deforested areas of Brazil where there is little fresh food, high rates of poverty and lack of employment regions.

Working in partnership with WWF and BNDES, we are aiming to raise US$17 million for a fund that will restore deforested land around the Amazon while generating carbon credits. Every 1,000 hectares restored can create 180 jobs and an economically sustainable future for these regions – a wonderful impact with excellent potential returns.

It is through this holistic process of active ownership, creative financing, and nature restoration that we believe we can make most impact towards ending deforestation in Brazil.